How your credit score affects your mortgage

Can you qualify for a mortgage? You might want to check your credit score. Learn how lenders handle your credit score and how you can improve it.

Read more

Can you qualify for a mortgage? You might want to check your credit score. Learn how lenders handle your credit score and how you can improve it.

Read more

Low-income homeowners who were previously denied a mortgage refinance may now qualify through RefiNow™. You may save up to $3k/yr by lowering your monthly costs.

Read more

Mortgages aren’t one-size-fits-all. To help you assess your options, learn all about understanding different home financing options.

Read more

Should you apply for a digital mortgage? Online lenders offer a wide range of benefits for homebuyers and refinancers who are looking to save time and money.

Read more

Your down payment is the biggest upfront cost of your mortgage. Learn about down payment requirements and other best practices.

Read more

Is that home really for sale? Learn what it means when you see "contingent" vs "pending" next to a real estate listing—and when you can still put in an offer.

Read more

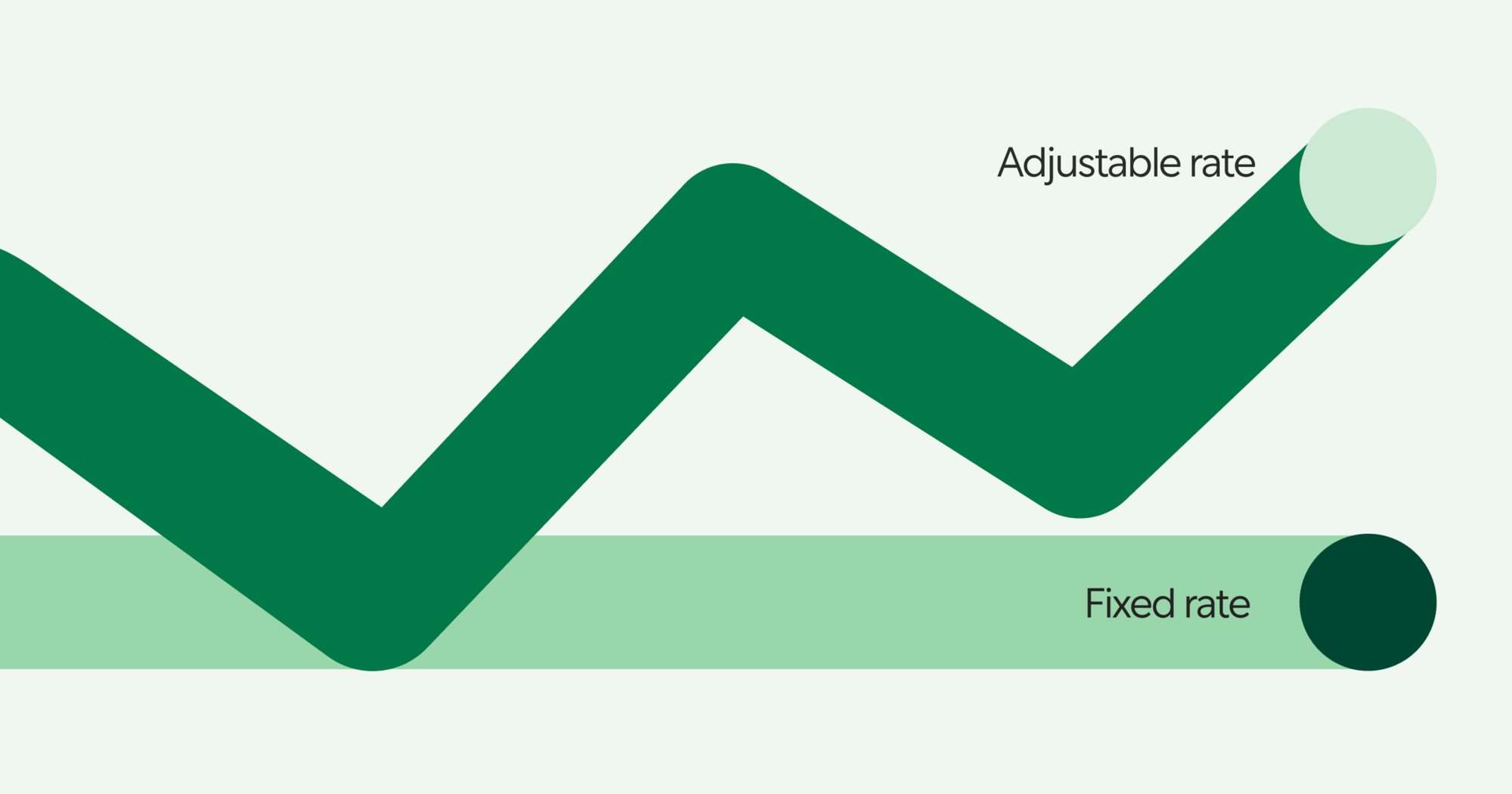

Trying to decide between a fixed-rate mortgage and an adjustable-rate mortgage? Here’s the difference, and how to figure out which home loan is right for you.

Read more

Homeownership can improve your finances and quality of life, but there are costs to prepare for. We break them all down so you can decide to buy or not to...

Read more

So you're considering a local mortgage lender? If you care about face-to-face interaction, they can't be beat. But there are some conveniences they can't offer.

Read more

If you’re thinking about buying a second home, there are some important rules to know. Learn about how to qualify for a mortgage on your second home.

Read more

Buying a home for the first time doesn’t have to be complicated. Formalize your budget, shop smart, and navigate the process with these pro tips.

Read more

Buying a house out of state can be seamless with the right prep. Learn how to find an agent, compare homes, and close without setting foot in the state.

Read more

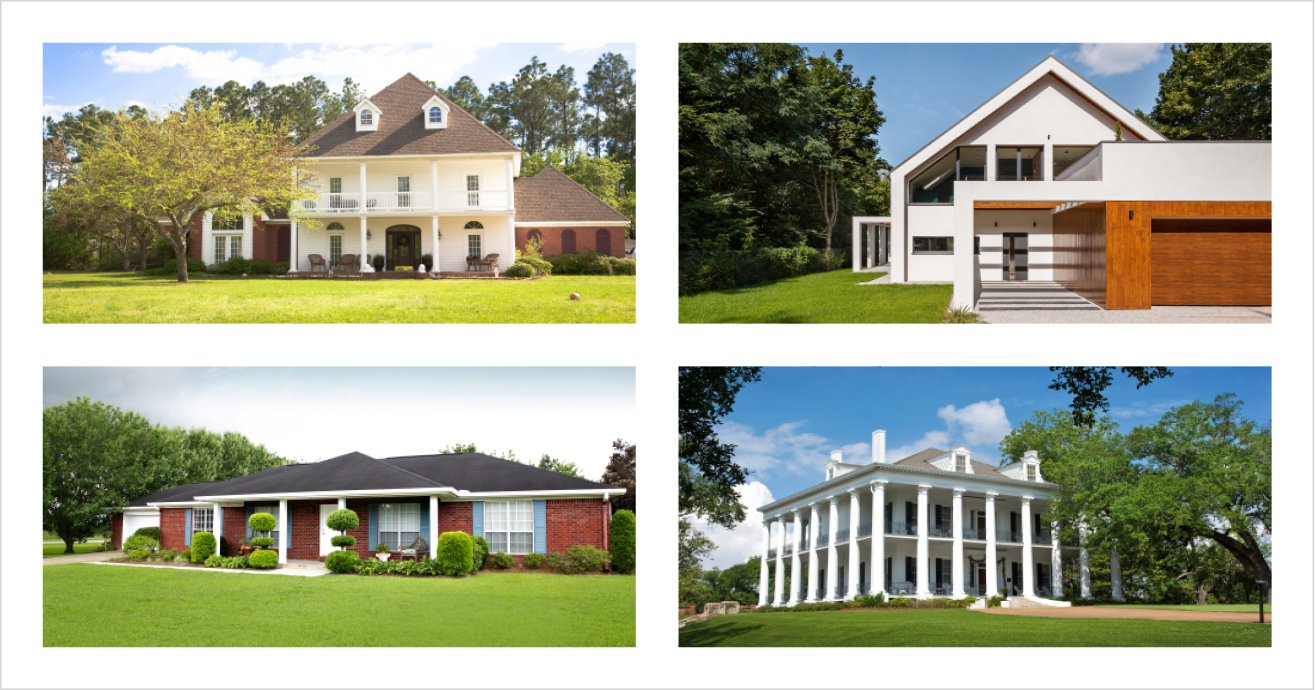

Learn about 14 different types of home styles, from ranch to Victorian, and discover which features, layouts, and designs best match your lifestyle and needs.

Read more

Learn what makes property value increase and learn 10 important factors that significantly impact how much a home is worth when buying, selling, or refinancing.

Read more

Looking for a house that truly fits your needs? Don't rely on a gut feeling. Get tips from a Better Real Estate Agent on how to know if a house...

Read more

The listing price isn’t the best way to gauge affordability. Look for these hidden costs of buying a home to accurately budget for your mortgage.

Read more

Better mortgages aren't “one-size-fits-all." Learn how to find a mortgage that fits your goals and budget with insights from founder and CEO Vishal Garg.

Read more

Each season has its pros and cons: We’ll help you identify your best time of the year to buy a house based on how you prioritize price, choice, and timing....

Read more

Mortgage application denied? Discover common reasons for denial and expert tips to strengthen your next application and boost your chances of getting approved.

Read more

Learn what a closing package is, why it matters, and how it finalizes your home purchase so you can confidently navigate the last step of the mortgage process.

Read more

Need something else? You can find more info in our FAQ