How much does mortgage pre-approval cost?

Learn if mortgage pre-approval is free or has costs, and understand what to expect from the process before you start the exciting journey of buying a new home.

Read more

Learn if mortgage pre-approval is free or has costs, and understand what to expect from the process before you start the exciting journey of buying a new home.

Read more

Looking to buy a property that makes money for you? Learn the minimum qualification requirements to get a mortgage pre approval for an investment property.

Read more

Many homebuyers boost their borrowing power by purchasing a home with a partner. Discover the benefits and learn how to get a joint mortgage pre-approval.

Read more

Here we deep dive into what you can expect when you transition from scrolling through homes online to going to open houses, making an offer, and closing.

Read more

Discover how loan subordination lets you refinance while keeping a second mortgage: What it is, how it works, key steps, and why it’s important.

Read more

Wondering if getting pre-approved hurts your credit? Discover how credit checks work and simple ways to keep your score safe during the mortgage process.

Read more

Homeowners who were previously denied a mortgage refinance may now qualify through RefiPossible™. You may save up to $3k/yr by lowering your monthly costs.

Read more

How long does a mortgage pre-approval last? Learn how long a mortgage pre-approval stays valid, what factors shorten it, and when to renew before it expires.

Read more

For one local man, being able to live on the river is much more than a perk—it’s personal.

Read more

Learn what pre-approval is, how to get the best possible results, and—most importantly—why it’s essential for a smooth home buying process.

Read more

Before you can close on a home or refinance a property, an underwriter will need to verify your income, debts, and assets. See what docs they need and why.

Read more

They didn’t think homeownership was in the cards. Now they’re living a life of leisure in Florida.

Read more

An appraisal contingency helps prevent homebuyers from overpaying, but sometimes they cause offers to be rejected. Learn when to add it, when to waive it.

Read more

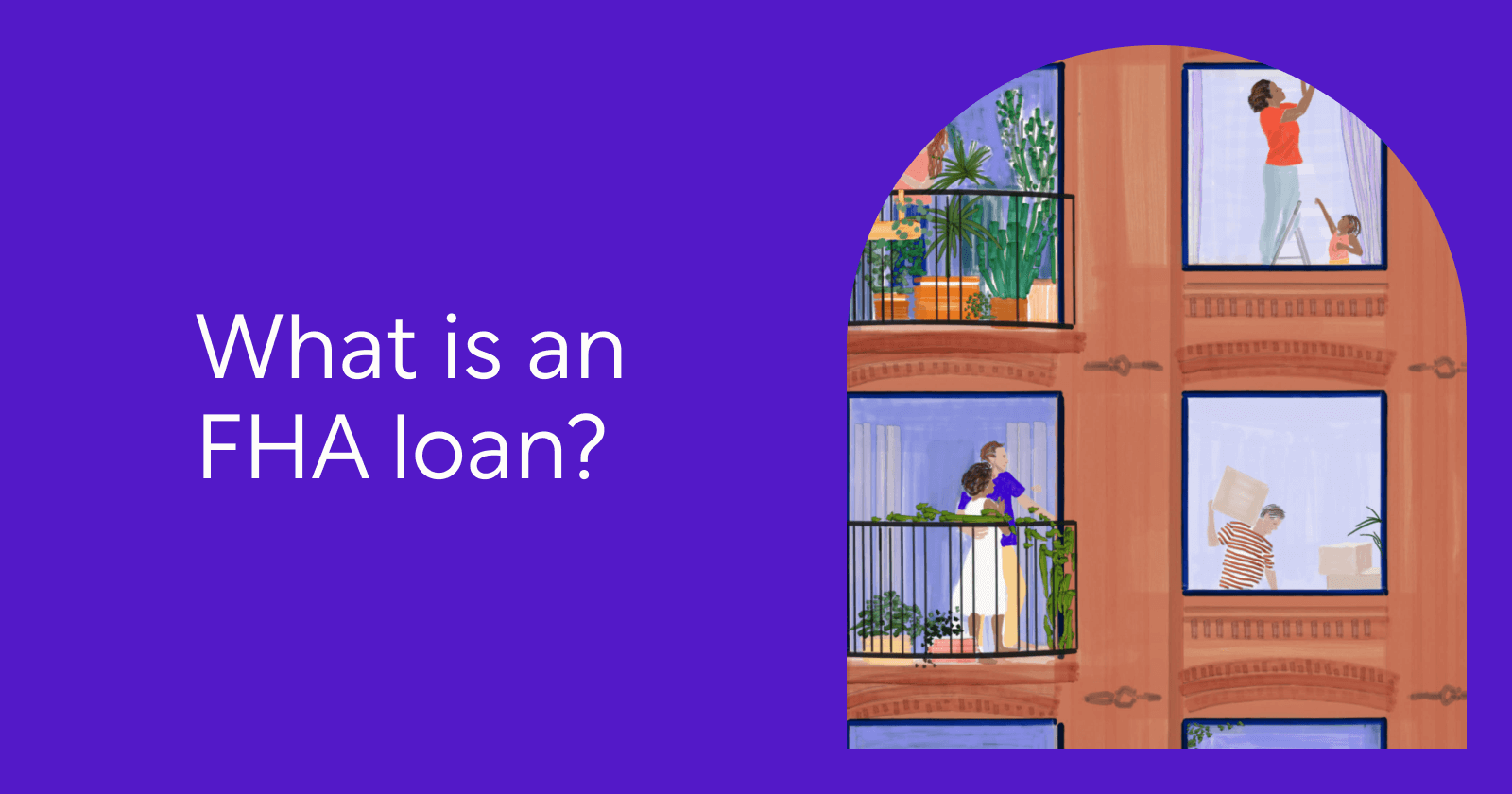

Explore FHA loan essentials: credit score and down payment thresholds, DTI, MIP costs, property standards, and how to apply with government-backed flexibility.

Read more

Here’s an intro to how FHA loans work, how to qualify, and which types of borrowers might be a good match for this type of mortgage.

Read more

Discover the 8 steps to buying a home with ease. This complete guide helps first-time buyers navigate the process confidently, from search to closing.

Read more

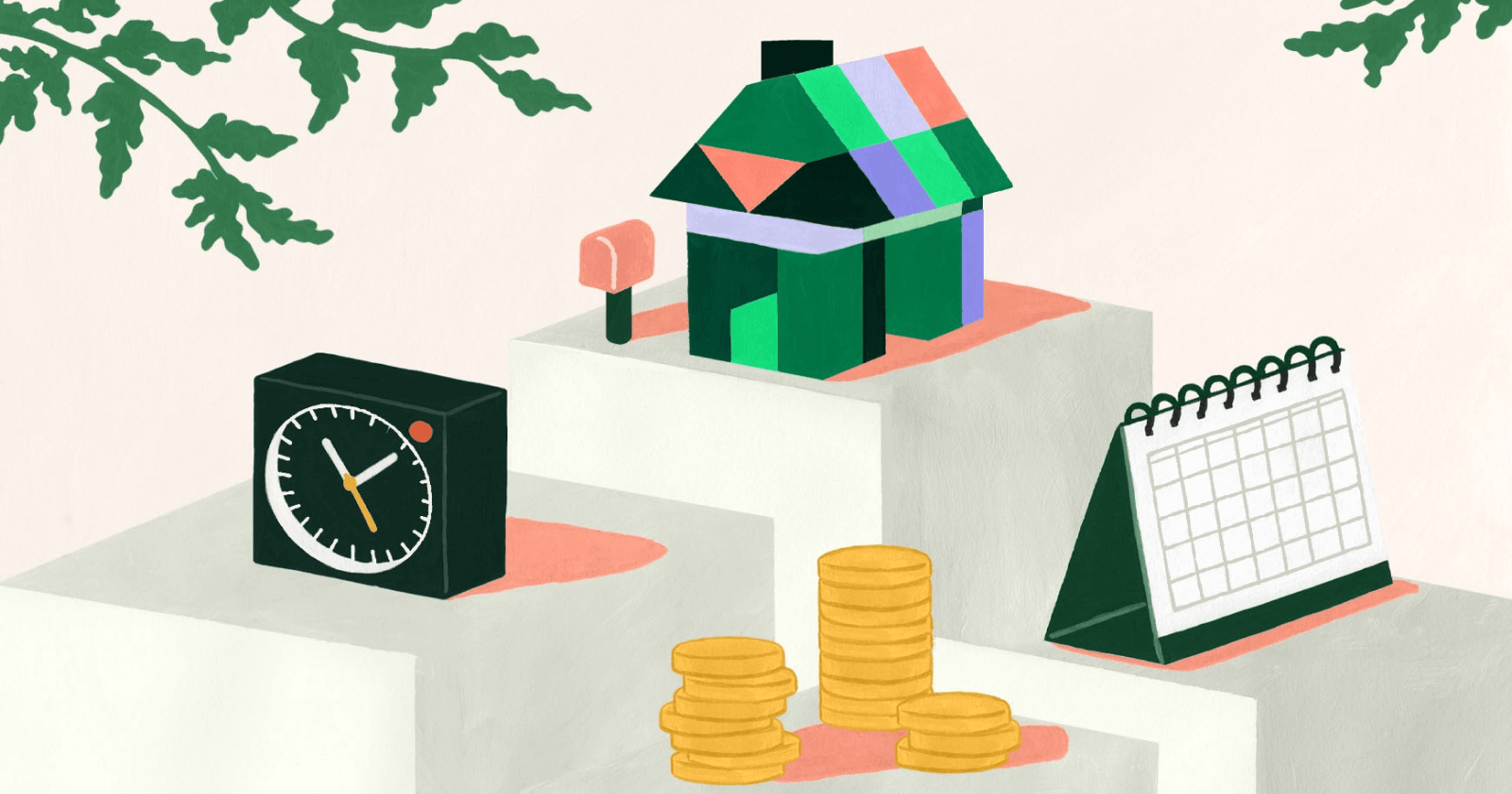

Tips for comparing the affordability of renting and buying a home, and deciding which one might be right for you.

Read more

Choosing the right neighborhood is one of the most important (and difficult) parts of buying a house. Here are some tips to help you make that decision.

Read more

There is more to a mortgage than meets the eye. Here’s what a mortgage really is, how it works, and the different options available.

Read more

Considering an out-of-state move? Don’t overlook these cities with lower costs of living and affordable homebuying options.

Read more

Need something else? You can find more info in our FAQ