How long does a mortgage pre-approval last?

How long does a mortgage pre-approval last? Learn how long a mortgage pre-approval stays valid, what factors shorten it, and when to renew before it expires.

Read more

How long does a mortgage pre-approval last? Learn how long a mortgage pre-approval stays valid, what factors shorten it, and when to renew before it expires.

Read more

For one local man, being able to live on the river is much more than a perk—it’s personal.

Read more

The foreclosure ban has ended. Find out what it means for millions of homeowners, the choices you face now, and how to safeguard your home today.

Read more

Learn what pre-approval is, how to get the best possible results, and—most importantly—why it’s essential for a smooth home buying process.

Read more

Before you can close on a home or refinance a property, an underwriter will need to verify your income, debts, and assets. See what docs they need and why.

Read more

Learn about how much money you can borrow with an FHA loan.

Read more

In this article, you'll learn how to calculate FHA Mortgage Insurance Premium (MIP). Discover factors influencing it and how it affects your monthly payments.

Read more

They didn’t think homeownership was in the cards. Now they’re living a life of leisure in Florida.

Read more

An appraisal contingency helps prevent homebuyers from overpaying, but sometimes they cause offers to be rejected. Learn when to add it, when to waive it.

Read more

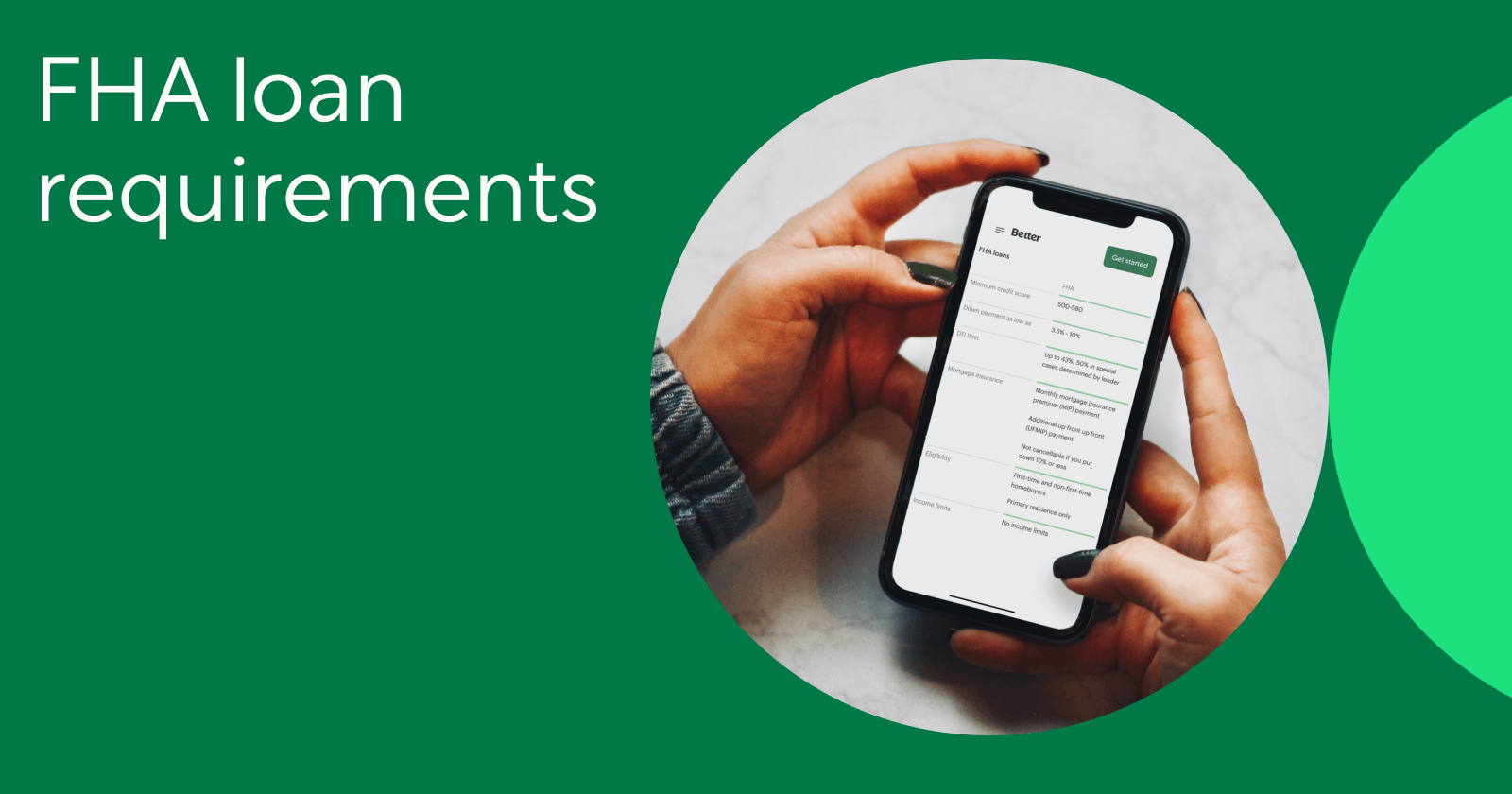

Explore FHA loan essentials: credit score and down payment thresholds, DTI, MIP costs, property standards, and how to apply with government-backed flexibility.

Read more

Here’s an intro to how FHA loans work, how to qualify, and which types of borrowers might be a good match for this type of mortgage.

Read more

When looking at a mortgage, paying points means paying more upfront for a lower interest rate. On the other hand, getting credits means paying less at closing in exchange for...

Read more

Buyers bidding this summer will deal with high seller expectations, competitive offers, and appraisal gaps; pausing the search may help avoid burnout for some.

Read more

Discover the 8 steps to buying a home with ease. This complete guide helps first-time buyers navigate the process confidently, from search to closing.

Read more

Tips for comparing the affordability of renting and buying a home, and deciding which one might be right for you.

Read more

Discover the story behind Better Mortgage and how one missed home inspired a simpler, faster way to buy a house. Your path to homeownership starts here.

Read more

Choosing the right neighborhood is one of the most important (and difficult) parts of buying a house. Here are some tips to help you make that decision.

Read more

There is more to a mortgage than meets the eye. Here’s what a mortgage really is, how it works, and the different options available.

Read more

Considering an out-of-state move? Don’t overlook these cities with lower costs of living and affordable homebuying options.

Read more

Can you qualify for a mortgage? You might want to check your credit score. Learn how lenders handle your credit score and how you can improve it.

Read more

Need something else? You can find more info in our FAQ