Builders lender trap: What homebuyers must know

Learn how a builder's lender trap could cost you more than you think. Discover smart ways to shop around and avoid common pitfalls in new home financing.

Read more

Learn how a builder's lender trap could cost you more than you think. Discover smart ways to shop around and avoid common pitfalls in new home financing.

Read more

FHA Streamlines offer a more streamlined process compared to a conventional refinance, with fewer requirements and faster processing.

Read more

A Home Equity Line of Credit is a versatile financial tool that allows homeowners to tap into the equity built in their homes to fund renovations and upgrades.

Read more

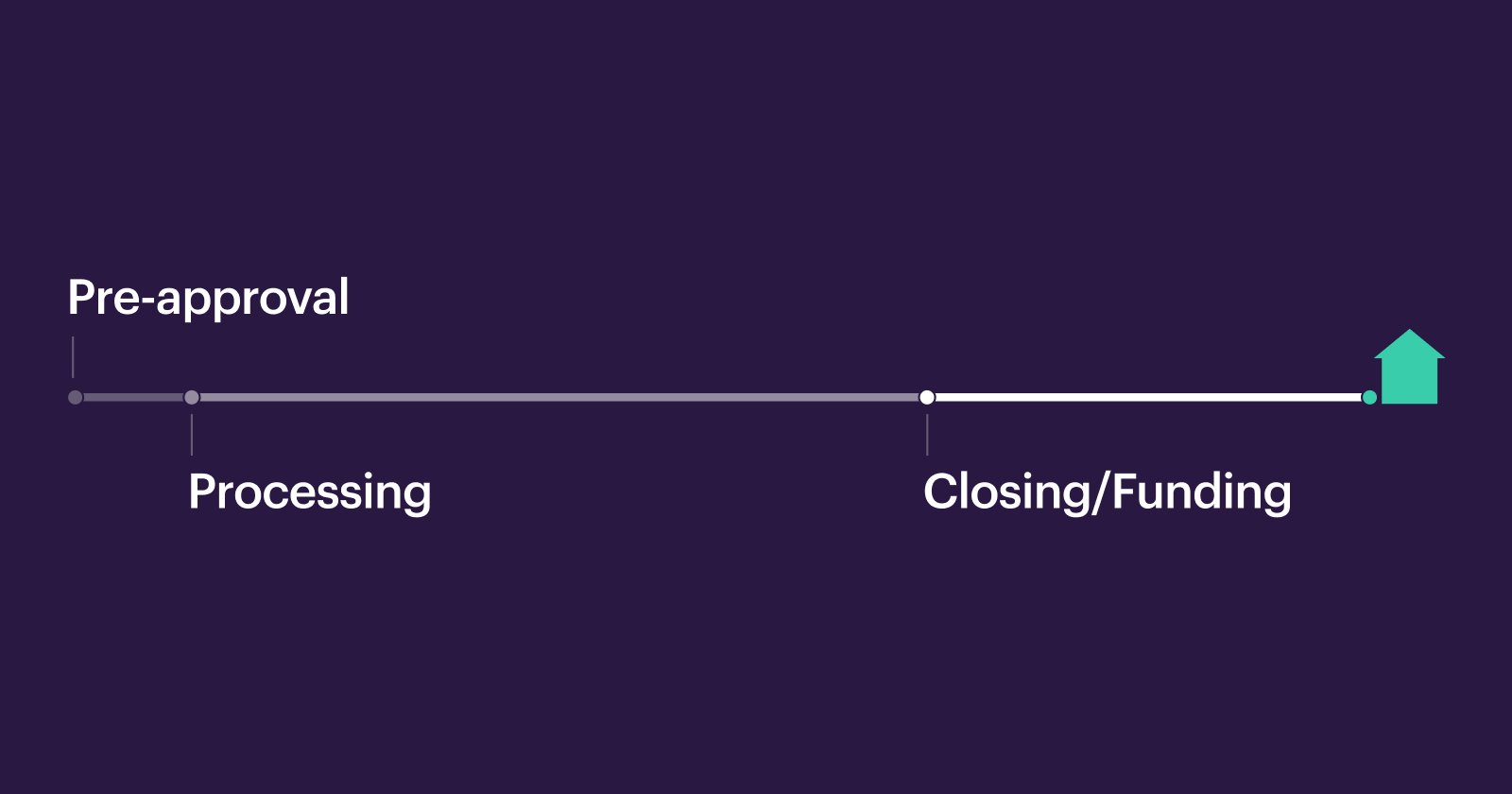

Explore our detailed home buying process timeline to understand each step from pre-approval to closing and learn how to move forward with confidence.

Read more

Home inspections give buyers peace of mind before closing on a home. Here’s a checklist and tips to help you prep for this process.

Read more

Your utility bills can eat up a large chunk of your monthly budget, but there are a number of ways you can cut costs. Check out our tips for saving....

Read more

Moving into a new home? Make sure you’re not overlooking any steps of our New Homeowner Checklist so you can start enjoying your new place as soon as possible.

Read more

Feeling out of place after a move? Learn how to make a new town feel like home by meeting neighbors, exploring shops, and giving new adventures a try.

Read more

Student loan forgiveness boosts buyer budgets, plus listing agreement timelines

Read more

Buyer opps, seller contingencies, and HELOC spending guide

Read more

Learn how to adjust shopping strategies, make sure that listing price is right, and earn cash poolside.

Read more

Learn how to ride the inventory wave, determine if your home is move-in ready, and ace your maintenance phase.

Read more

Meet a couple who landed their dream home with high-speed help from Better Mortgage. Plus, the renovations that boost your home value and a tip for winning with cash.

Read more

Buying a home isn’t impossible for low income families. In fact, there are loans designed to help. Learn which ones to look for in our low income loan guide.

Read more

Conventional loans are the most common mortgage type in the US. Here we explain what makes them different from other mortgage options and how to get one.

Read more

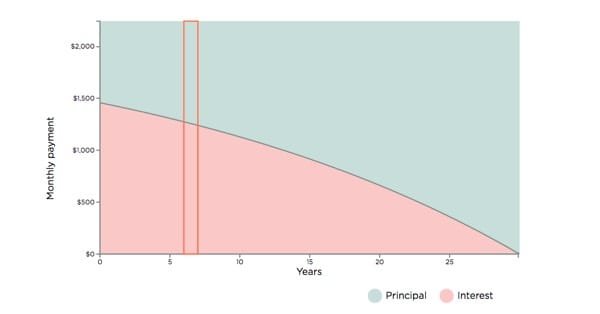

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

A lot goes into making an offer on a home. Here are the 6 steps—from determining your price to sealing the deal.

Read more

Closing costs are going up around the country, but choosing the right lender can help you save more on a new loan.

Read more

Agents who invest in connecting with first-time homebuyers and single borrowers may see increased success in netting clients.

Read more

Explore the essentials of buying an Airbnb investment property with Better.com. Learn about market research, property types, financing options, and the pros and cons of Airbnb investments. Get expert tips...

Read more

Need something else? You can find more info in our FAQ