You could save on monthly costs with RefiPossible™

Homeowners who were previously denied a mortgage refinance may now qualify through RefiPossible™. You may save up to $3k/yr by lowering your monthly costs.

Read more

Homeowners who were previously denied a mortgage refinance may now qualify through RefiPossible™. You may save up to $3k/yr by lowering your monthly costs.

Read more

An appraisal contingency helps prevent homebuyers from overpaying, but sometimes they cause offers to be rejected. Learn when to add it, when to waive it.

Read more

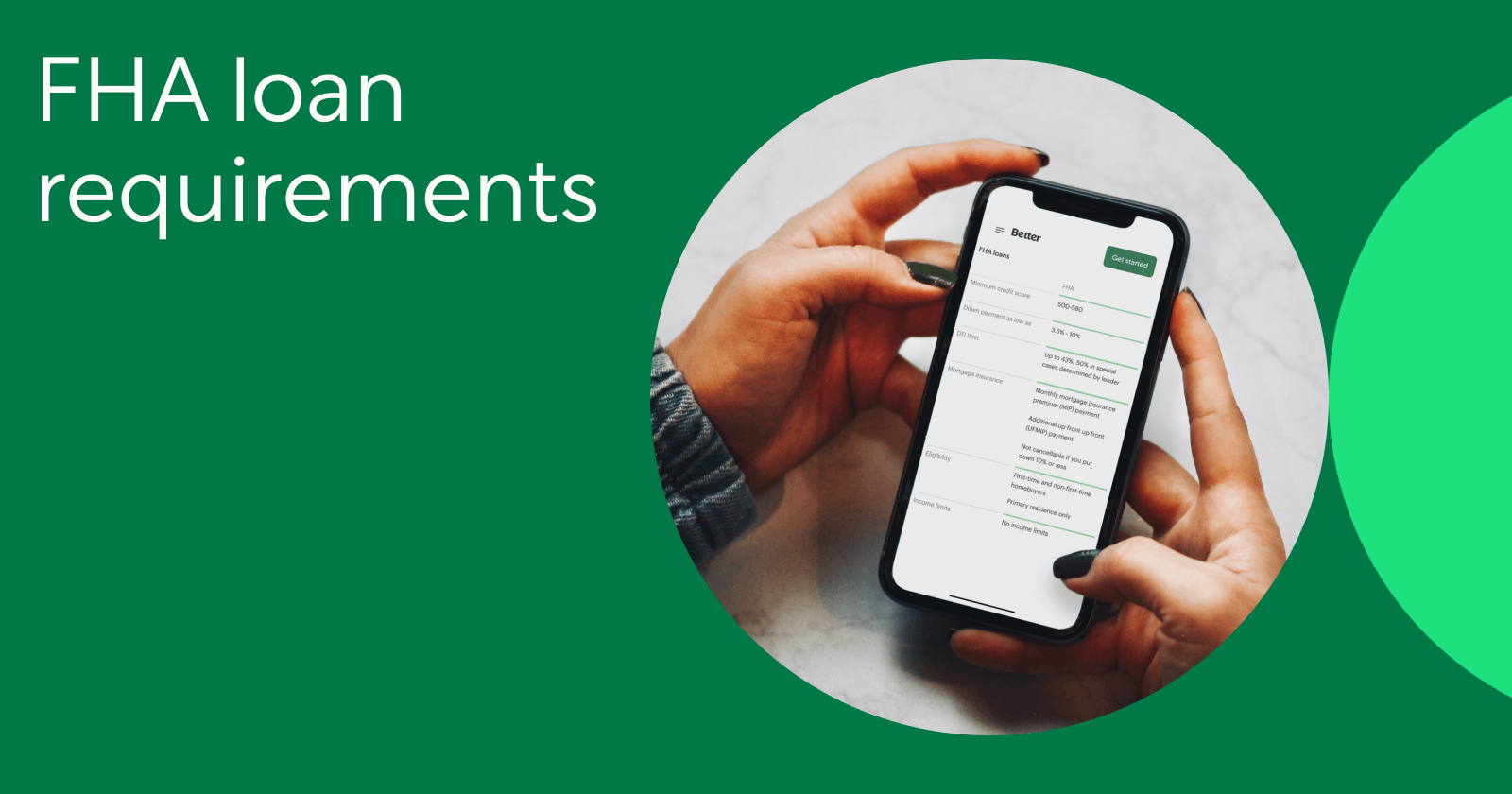

Explore FHA loan essentials: credit score and down payment thresholds, DTI, MIP costs, property standards, and how to apply with government-backed flexibility.

Read more

Here’s an intro to how FHA loans work, how to qualify, and which types of borrowers might be a good match for this type of mortgage.

Read more

Tips for comparing the affordability of renting and buying a home, and deciding which one might be right for you.

Read more

There is more to a mortgage than meets the eye. Here’s what a mortgage really is, how it works, and the different options available.

Read more

Can you qualify for a mortgage? You might want to check your credit score. Learn how lenders handle your credit score and how you can improve it.

Read more

Low-income homeowners who were previously denied a mortgage refinance may now qualify through RefiNow™. You may save up to $3k/yr by lowering your monthly costs.

Read more

Should you apply for a digital mortgage? Online lenders offer a wide range of benefits for homebuyers and refinancers who are looking to save time and money.

Read more

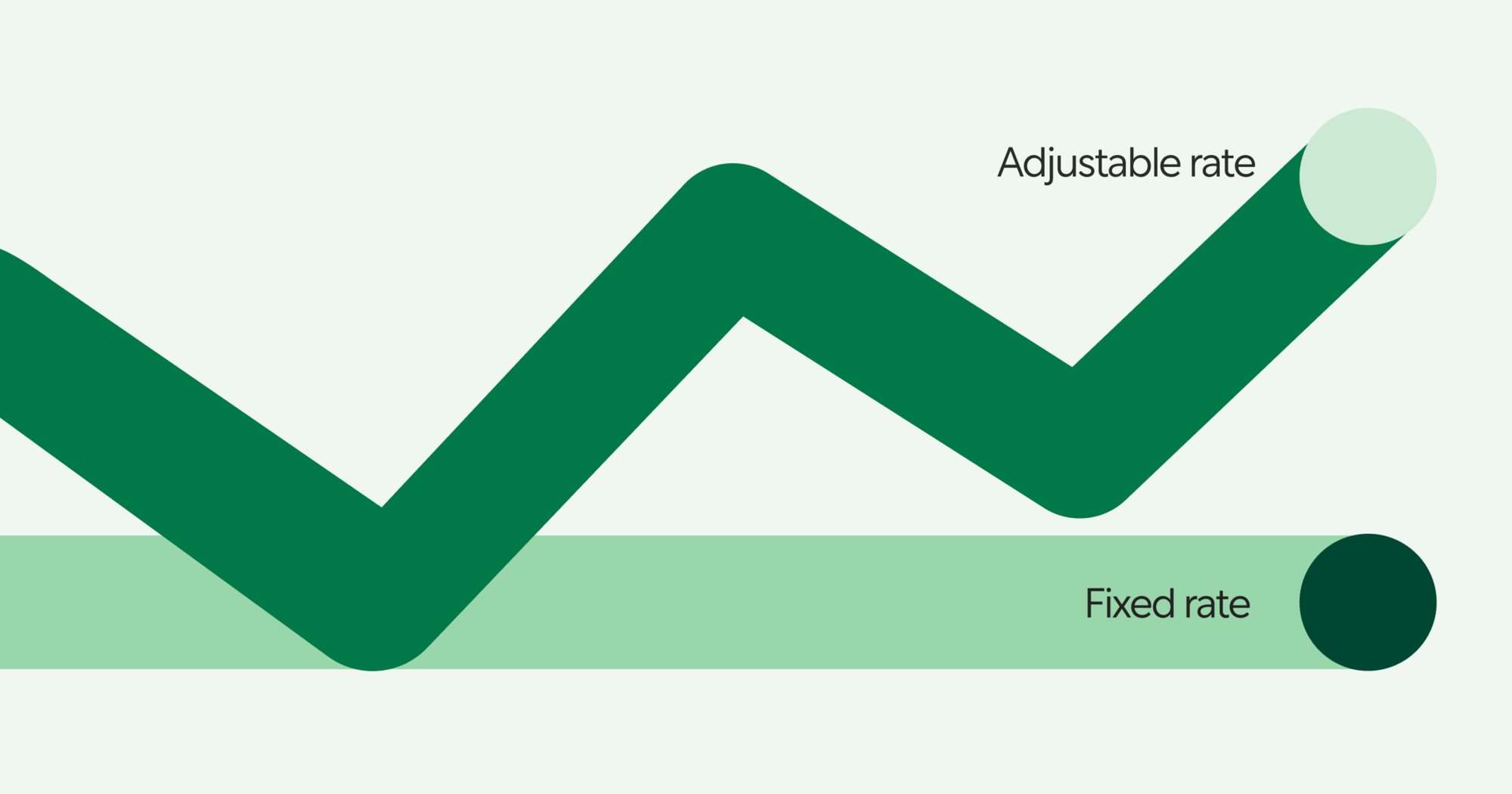

Trying to decide between a fixed-rate mortgage and an adjustable-rate mortgage? Here’s the difference, and how to figure out which home loan is right for you.

Read more

If you’re refinancing a mortgage, locking your interest rate now can help you save money in the long run. Here’s how to decide if you should lock your rate today.

Read more

Learn what makes property value increase and learn 10 important factors that significantly impact how much a home is worth when buying, selling, or refinancing.

Read more

Better mortgages aren't “one-size-fits-all." Learn how to find a mortgage that fits your goals and budget with insights from founder and CEO Vishal Garg.

Read more

Mortgage application denied? Discover common reasons for denial and expert tips to strengthen your next application and boost your chances of getting approved.

Read more

Learn what a closing package is, why it matters, and how it finalizes your home purchase so you can confidently navigate the last step of the mortgage process.

Read more

Refinancing may help you save money and give you access to your home equity. Here are the pros and cons of refinancing, and scenarios when it makes sense.

Read more

Consolidate high-interest debt with a cash-out refinance from Better Mortgage.

Read more

Find out what makes Better a different kind of online mortgage lender. Our innovative technology, honest rates, and friendly humans are just the beginning.

Read more

If you’re interested in a no-cost refinance, there are two ways to do it: Taking lender credits & rolling in your closing costs. Here we explore both.

Read more

Thinking of applying for a home loan? Learn the pros and cons of a 15 year vs. 30 year fixed rate mortgage in a new article from Better Mortgage.

Read more

Need something else? You can find more info in our FAQ