What is included in closing costs?

Every real estate transaction comes with fees, no matter how you pay. Learn what is included in closing costs, when they’re due, and what they all mean.

Read more

Every real estate transaction comes with fees, no matter how you pay. Learn what is included in closing costs, when they’re due, and what they all mean.

Read more

What is an escrow account? Learn how it works, and why it helps protect buyers, sellers, and lenders. Discover the types, rules, and their real estate benefits.

Read more

Learn how title and settlement services help you close on a home, from title searches to insurance, escrow, and signing, plus what to expect at every step.

Read more

Two ways that refinancing can benefit homeowners going through a divorce

Read more

Protect your new home with safety measures designed to combat the risk of fire, carbon monoxide poisoning, flooding, and burglary.

Read more

Confused about no cash out refinance vs. limited cash out refinance? Discover the benefits, differences, and which option is best for your mortgage strategy.

Read more

Learn the pros and cons of a cash out refinance to help you decide if the financial move is right for you.

Read more

With a cash out refinance, you take out a new mortgage for more money than you owe on your current loan. The difference is paid to you in cash.

Read more

Use this cash out refinance calculator to see how much you could borrow and what the cost of your new monthly payment would be.

Read more

Looking for mortgage advice? This guide breaks down rates, refinancing, and top FAQs to help you choose the best loan and timing for your home financing goals.

Read more

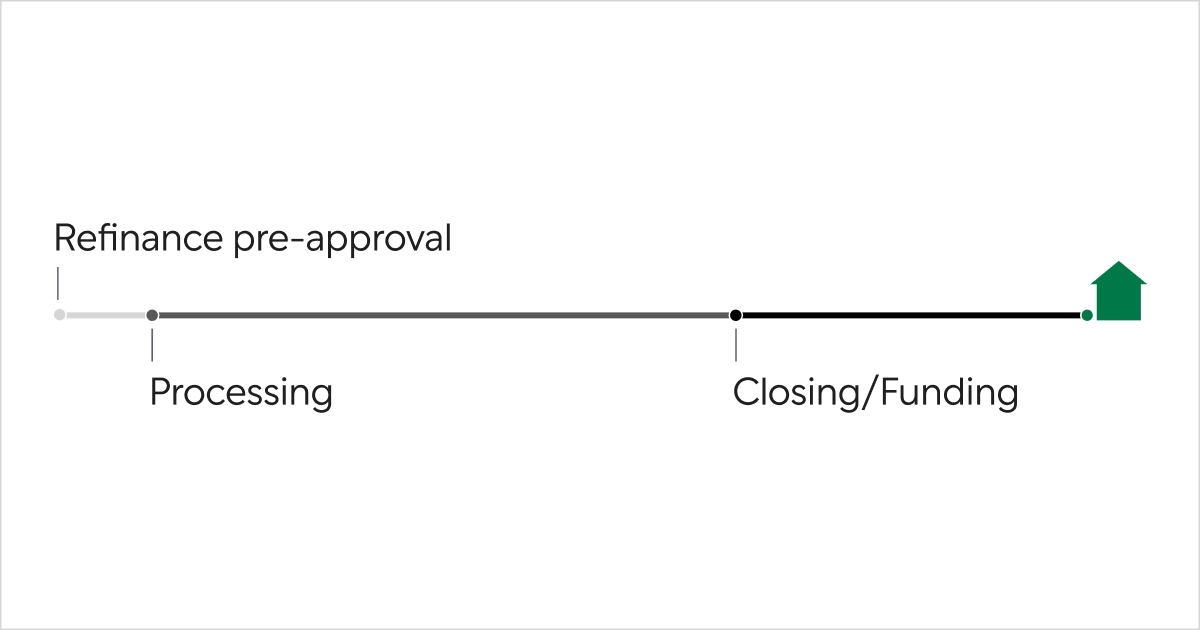

Refinancing can help homeowners save money, but the process can be complex. Here's how Better simplifies it and what you can expect from start to finish.

Read more

HomeReady vs FHA loans: See how an affordable home financing program that offers low down payment options like HomeReady stacks up against FHA loans.

Read more

Learn how a loan estimate reveals real mortgage costs, compares lenders, and highlights fees you can control. Explore its sections and compare offers clearly.

Read more

In the socially distanced world of 2020, Better helped 88,100+ new clients navigate their homeownership journey with ease, confidence, and a ton of savings.

Read more

Learn what the underwriting process timeline looks like, what underwriters review, common approval conditions, and how Better helps speed up the process.

Read more

Second mortgages can be used to pay off debts, but they do come with risks. Learn about HELOCs, home equity loans, and piggyback loans in this new Better Mortgage article.

Read more

Discover what affects a home appraisal for refinance, including how cleanliness and other factors may influence its value. Learn what appraisers look for and how to prepare your home.

Read more

When you apply for a mortgage, your lender might ask for your tax returns. Here's why they’re requested and how they can affect your mortgage application.

Read more

Thinking about refinancing your mortgage? Learn when to refinance, the benefits, and key factors to help you decide if now is truly the right time for you.

Read more

Whether you plan on selling your house soon or intend on staying for a while, here are some smart home renovations that can help boost your home’s value.

Read more

Need something else? You can find more info in our FAQ