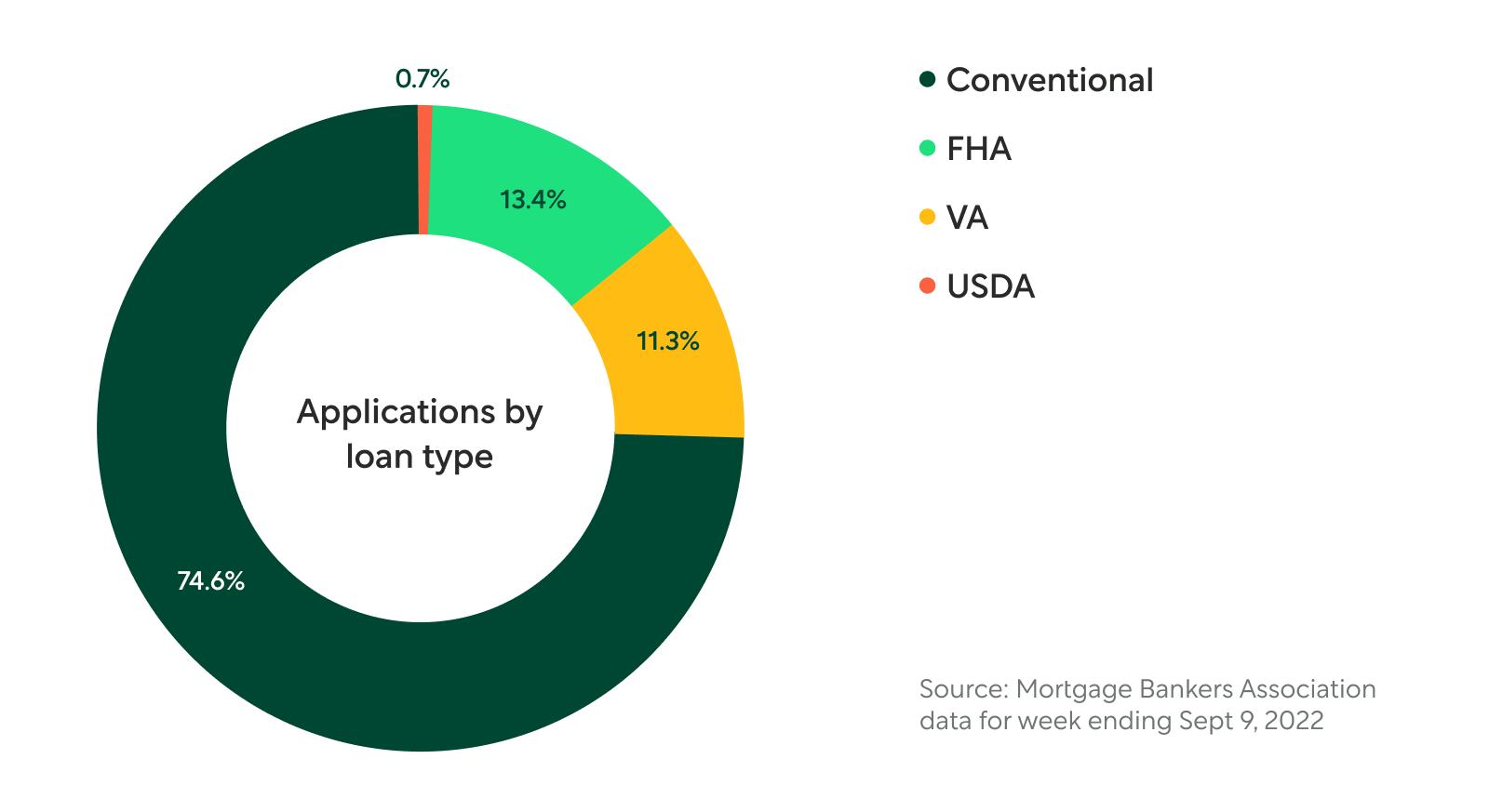

Mortgage pie + PSL vs PMI

First year cost cheat sheet for homebuyers + sensory staging advice for sellers

Read more

First year cost cheat sheet for homebuyers + sensory staging advice for sellers

Read more

Mortgage contingencies in a correcting market, plus seller strats and renos w ROI

Read more

A guide for buy-curious renters, simple staging strats, and water safety musts

Read more

Check out recent lending reforms, ask before you sell, and fireproof your property

Read more

Leverage your lock, refresh outdoor spaces, and check local listing trends

Read more

Hitting homebuyer stride, going low in listing limbo, and beating buyer’s remorse

Read more

Check out which cities are seeing big price drops, the top amenities you need if you’re renting out your vacation home, and a good summer home upgrade.

Read more

Need the tools to find the right rental property for you? It all comes down to how to think about your return on investment.

Read more

DIY home improvements fueled by cash-out refinances have grown in popularity since 2020. These tips will help you get the most out of your renovation.

Read more

Home prices are up, interest rates are up, which also means credit card rates are up. Learn how a cash-out refi can help you lower costs and save on interest....

Read more

The Fed’s latest rate hike is taking effect, but ARMs could be the answer for homeowners looking to save on their mortgage. Plus 3 other ways to save.

Read more

Discover how single women are flexing their homebuying power, find out the best week to list your home if you’re looking to sell, and why Phoenix, AZ is so hot.

Read more

Home values are growing higher than job earnings, making it a good time to see how you can tap into your home equity.

Read more

The spring market comes with low inventory and intense competition, but buyers can win by being prepared to move fast.

Read more

Learn why millennials are buying vacation homes first, homeowners are thinking about becoming landlords, and considerations for buying in LA.

Read more

Discover how this couple saved big on their new build home with smart tips, expert strategies, and financing advice. Learn how to save on your dream home too!

Read more

Moving up your homebuying timeline could help you afford more in today’s market.

Read more

Builders are ramping up to meet homebuyer demand, and the fresh inventory could help cool off rising new home prices.

Read more

You can now borrow roughly $100,000 more in a conforming loan. The move should help buyers keep up with rising home prices.

Read more

Need something else? You can find more info in our FAQ