How to determine the fair market value of a home?

Discover how to determine the fair market value of a home. Understand what it is, the key factors influencing property value, and its uses in real estate.

Read more

Discover how to determine the fair market value of a home. Understand what it is, the key factors influencing property value, and its uses in real estate.

Read more

Wondering if you can sell your house if you have a HELOC? The short answer is yes. Learn how the process works and what to expect when it’s time to...

Read more

Discover how to get rid of PMI and save on mortgage payments. Explore actionable strategies, cancellation criteria, and decide if removing PMI is worth it.

Read more

Touring homes is an exciting part of the home purchase journey. Here’s a guide to help you tick all the (not-so-obvious) boxes to find your dream home.

Read more

Check the FHFA Conforming Loan limit increase for 2025 and how it could impact homebuyers, lenders, and the housing market. Stay updated on new mortgage limits.

Read more

Discover how a VA IRRRL can cut your rate and payment with fewer documents, no appraisal, and rolled in costs. Start your streamlined veteran refinance today.

Read more

Explore our detailed home buying process timeline to understand each step from pre-approval to closing and learn how to move forward with confidence.

Read more

Better has officially gone public! Explore 10 pivotal milestones that defined our mission to transform the mortgage process and make homeownership accessible.

Read more

Home inspections give buyers peace of mind before closing on a home. Here’s a checklist and tips to help you prep for this process.

Read more

Your utility bills can eat up a large chunk of your monthly budget, but there are a number of ways you can cut costs. Check out our tips for saving....

Read more

Moving into a new home? Make sure you’re not overlooking any steps of our New Homeowner Checklist so you can start enjoying your new place as soon as possible.

Read more

A recently divorced single mom uses Better’s Cash Offer to get a home for her family lightning quick.

Read more

Buying a home isn’t impossible for low income families. In fact, there are loans designed to help. Learn which ones to look for in our low income loan guide.

Read more

Conventional loans are the most common mortgage type in the US. Here we explain what makes them different from other mortgage options and how to get one.

Read more

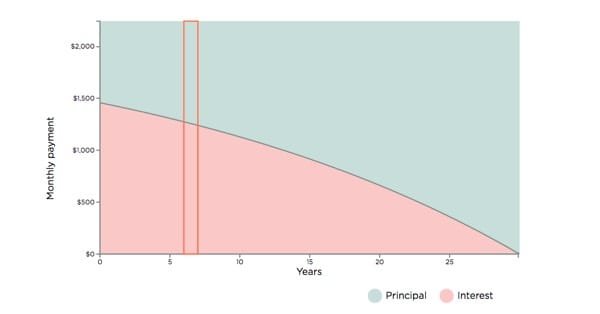

Try this interactive amortization calculator to find the amortization schedule for any fixed-rate mortgage.

Read more

A lot goes into making an offer on a home. Here are the 6 steps—from determining your price to sealing the deal.

Read more

Jumbos are about the size of the loan, not the size of the home. See what a jumbo loan is, where you might need one, and how to avoid them...

Read more

Explore the essentials of buying an Airbnb investment property with Better.com. Learn about market research, property types, financing options, and the pros and cons of Airbnb investments. Get expert tips...

Read more

Here’s what our underwriters take into consideration when reviewing applications from self-employed borrowers.

Read more

Use our home appraisal checklist to maximize your property’s value, whether buying, selling, or refinancing. Prepare for success with expert tips and guidance.

Read more

Need something else? You can find more info in our FAQ