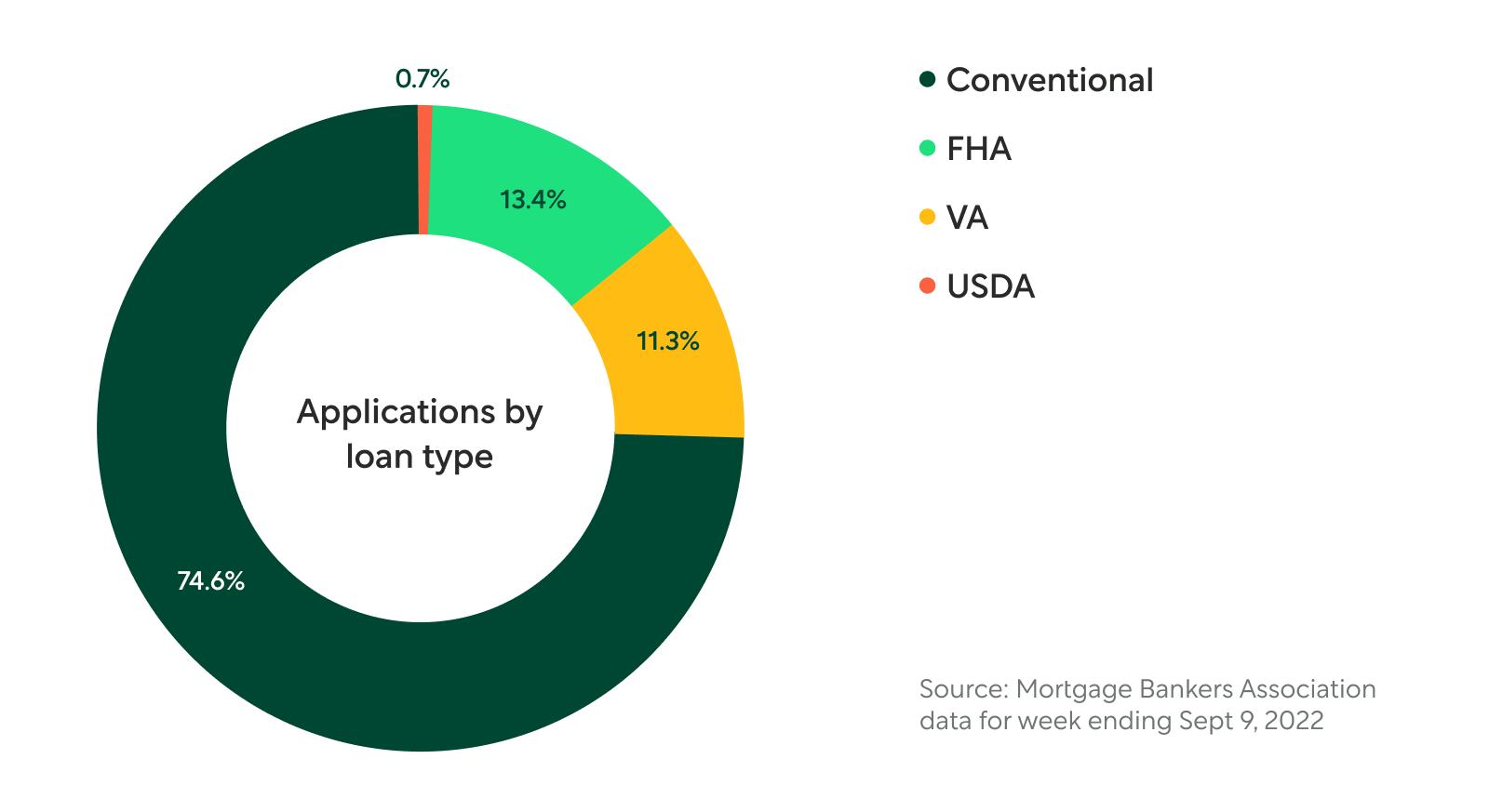

Mortgage pie + PSL vs PMI

First year cost cheat sheet for homebuyers + sensory staging advice for sellers

Read more

First year cost cheat sheet for homebuyers + sensory staging advice for sellers

Read more

Life insurance requires an understanding of different policies and coverage needs. Better Cover can make the process of getting coverage quick and simple.

Read more

Term life insurance protects your loved ones if your death occurs during a set coverage period and can be a low-cost way to protect your family financially.

Read more

Mortgage contingencies in a correcting market, plus seller strats and renos w ROI

Read more

Explore top first-time home buyer programs in Texas, including grants, loans, and tax credits to help you save on your first home purchase and closing costs.

Read more

A guide for buy-curious renters, simple staging strats, and water safety musts

Read more

Down payments and closing costs can make homeownership a struggle for many first-time buyers. Luckily, Texans have a number of assistance programs that can help.

Read more

Check out recent lending reforms, ask before you sell, and fireproof your property

Read more

Leverage your lock, refresh outdoor spaces, and check local listing trends

Read more

Hitting homebuyer stride, going low in listing limbo, and beating buyer’s remorse

Read more

Confused about no cash out refinance vs. limited cash out refinance? Discover the benefits, differences, and which option is best for your mortgage strategy.

Read more

Learn the pros and cons of a cash out refinance to help you decide if the financial move is right for you.

Read more

With a cash out refinance, you take out a new mortgage for more money than you owe on your current loan. The difference is paid to you in cash.

Read more

Check out which cities are seeing big price drops, the top amenities you need if you’re renting out your vacation home, and a good summer home upgrade.

Read more

Need the tools to find the right rental property for you? It all comes down to how to think about your return on investment.

Read more

Use this cash out refinance calculator to see how much you could borrow and what the cost of your new monthly payment would be.

Read more

DIY home improvements fueled by cash-out refinances have grown in popularity since 2020. These tips will help you get the most out of your renovation.

Read more

Home prices are up, interest rates are up, which also means credit card rates are up. Learn how a cash-out refi can help you lower costs and save on interest....

Read more

The Fed’s latest rate hike is taking effect, but ARMs could be the answer for homeowners looking to save on their mortgage. Plus 3 other ways to save.

Read more

Need something else? You can find more info in our FAQ